Acquisition is growth strategy in which the company purchases or takes over another business. In this manner the company can enter new markets or new products or get access to a new distribution channel. The company which acquires new business needs to manage the acquisition carefully otherwise it could financially be suffered. It can make phase wise payments so that these are matched to the funds generated by the organisation. The logic behind the acquisition is that companies are always available for being acquired. However, when the choice facing the company is limited then it can expedite the acquisition process. In an acquisition the firm buys a controlling stake in the target company. This is done with the intention of making it a subsidiary business or merging With one of the existing businesses of the acquiring company. For most companies acquisition is a one-time activity which is done With a specific objective in mind. The process of acquisition is a case of dominance of one company over the other. Here a bigger company will take over the shares and assets of the smaller company and either run it under the bigger company’s name or might run it under a combined name. The acquisition is an act of dominance. In this the target company is taken over by the acquiring company. After this it is run either in the acquiring company’s name or by a new name. For example, when Satyam was taken over by Mahindra and Mahindra, the erstwhile Satyam name got merged in Tech Mahindra.

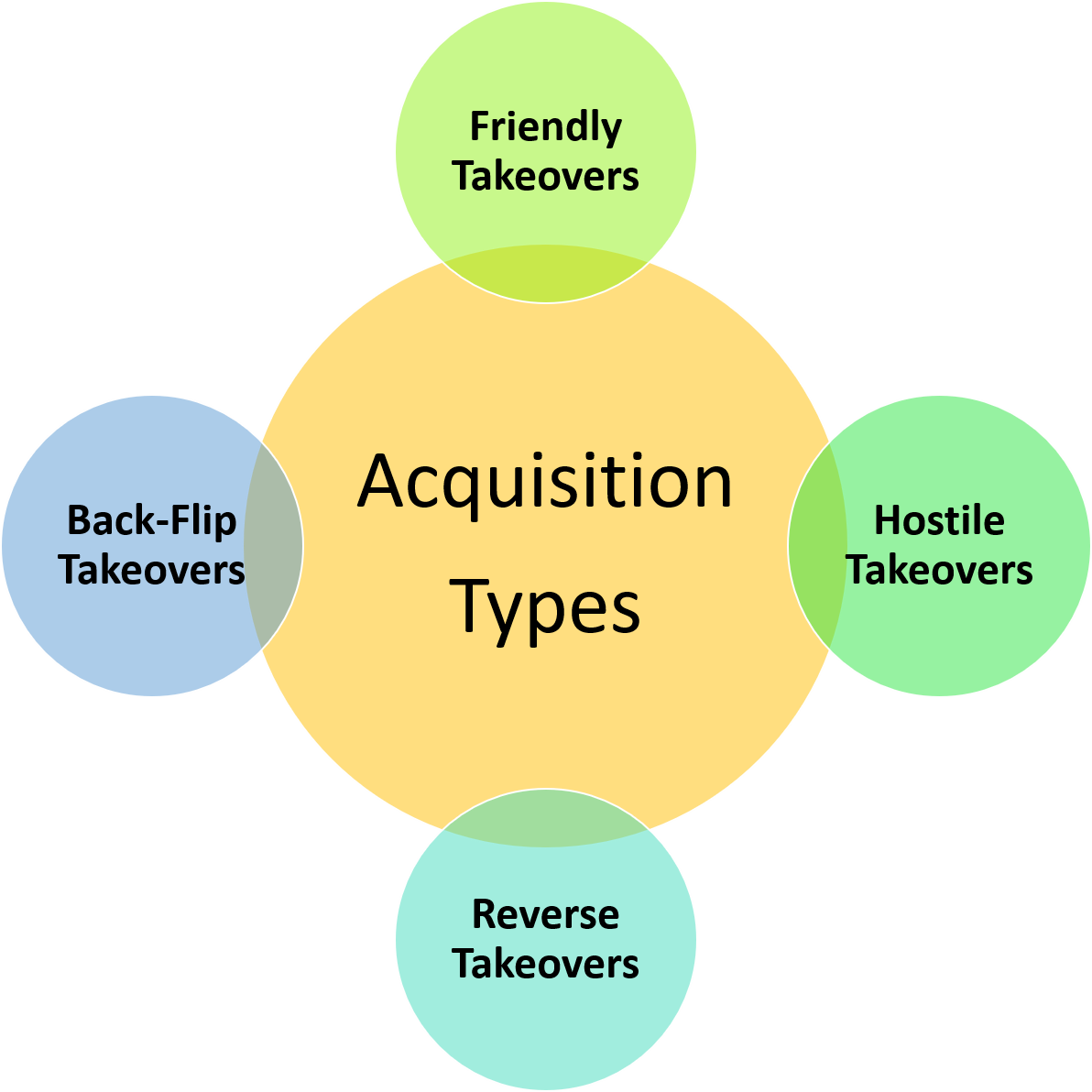

Types of Acquisitions

Types of acquisitions are as follows:

Friendly Takeovers: In this type of takeover the acquiring company notifies the target company’s board of directors of their bid. The board decides if accepting the offer is in the best interests of the shareholders of the company or not and accordingly makes the decision. In private companies, the board of directors is usually the majority shareholders and hence private acquisitions are friendly in nature. In case the shareholders decide to sell the company, then the board of directors already has instructions to accept the friendly bid request.

Hostile Takeovers: In this the acquiring company tries to acquire the target company in the face of severe opposition from the target company. In this, the acquiring company actively continues with its acquisition efforts even after the board of directors has rejected its bid offer or the acquirer company makes the bid without informing the board of directors of the target company. It is a kind of takeover strategy in which a lot of opposition has to face by the acquiring organisation from the target firm. Under the hostile takeover, despite the acquisition bid rejected by the board of directors of the target company, the acquisition firm continues to perform acquiring activities and without giving any information to the board of directors, acquisition is conducted. Hostile takeover is ethical in nature. This is because, in most of the cases, the victims of the hostile takeover are the weak firms and a lot of benefits are obtained by its customers and shareholders from such takeovers. There may be some managers and employees who might lose their jobs While some may get additional benefits during the activities of hostile takeover. Thus can be some arguments regarding the ethicality of hostile takeovers.

Reverse Takeovers: Reverse Takeovers or RTOS is a type of merger activity in which the acquiring company tries to get itself publicly traded without going for an initial public offering. In this the private company first buys enough shares in a publicly traded company through the open market. It then tries to swap its shares for the shares of the publicly traded company. It thus becomes publicly traded indirectly.

Back-Flip Takeovers: This is a rather uncommon type of takeover in which the acquirer company becomes a subsidiary of the target company. After the takeover the business is carried out in the name of the acquired company. This is called a back flip takeover because in a conventional takeover the new entity typically takes the name Of the acquiring company. In the case of Back-flip takeover it is the opposite. The acquired company assets are taken over by the acquiring company and the control of the business is usually in the hands of the acquirer company. This is typically because the acquiring company is of sounder financial health and the acquired company is a struggling entity. For example, this was the case in the Satyam takeover by Mahindra and Mahindra.

Advantages of Acquisitions

Assets Acquisition: Acquisitions help the acquiring company to decide which Ofthe assets Of the target company it wants to acquire and which liabilities it wants to take.

Gain Experience and Assets: Another benefit of an acquisition is that the acquiring company quickly gains the goodwill and market reputation of the target company. If the acquired company gels well with the business and culture of the acquiring company, then the resultant will be an increase in the efficiency and profitability of the organisation.

Excite the Shareholders: An acquisition typically has the effect of exciting the stockholders of the company. The stock market takes this as a sign that the organisation is taking steps to increase growth and this improves the stock price of the company.

Combining Organisation Cultures: Another advantage of an acquisition is that it brings about an amalgamation of two organisational cultures,

Reducing Costs and Overheads: The company can also reduce costs and overheads by reducing all duplication of activities in marketing, sales and administration.

Disadvantages of Acquisition

Cost: Acquiring another organisation can be a very expensive proposition and the acquiring company has to release lot of precious financial resources for the acquisition. This prevents the funding of other critical projects and businesses in the company. The company can also resort to debt markets to finance the takeover. In this case the debt levels of the company soar and if the returns from the target company are less than the short term profitability Of the company is affected. Acquiring a new company through the issuance Of stock also has its drawbacks as the shareholders holding percentage drops in the company and they have to forego control in the organisation.

Employee Retention: Once the acquisition is completed, there are a lot of people who are performing similar tasks in the organisation. Reallocation of these employees becomes a very difficult task. Typically the acquirer company may resort to firing of excess workers. Many a time’s employees pre-empt the management by leaving for greener pastures before the acquisition is completed. This increases the attrition rate in the organisation.

Letter of Intent: All acquisitions have to be accompanied by a letter of intent. This includes a confidentiality agreement as the buyer could cancel the payment and use the sellers’ business knowledge and trade secrets. This letter of intent safeguards the interests of the seller.

Value: The method of valuation of the combined entity is critical. The assets of a company include many intangible assets like goodwill and brand equity. These can be destroyed if the acquirer company has a negative reputation.

Duplication: The acquisition also creates lot of duplication in the two companies. There are many people in both the organisations, who are engaged in performing similar tasks.