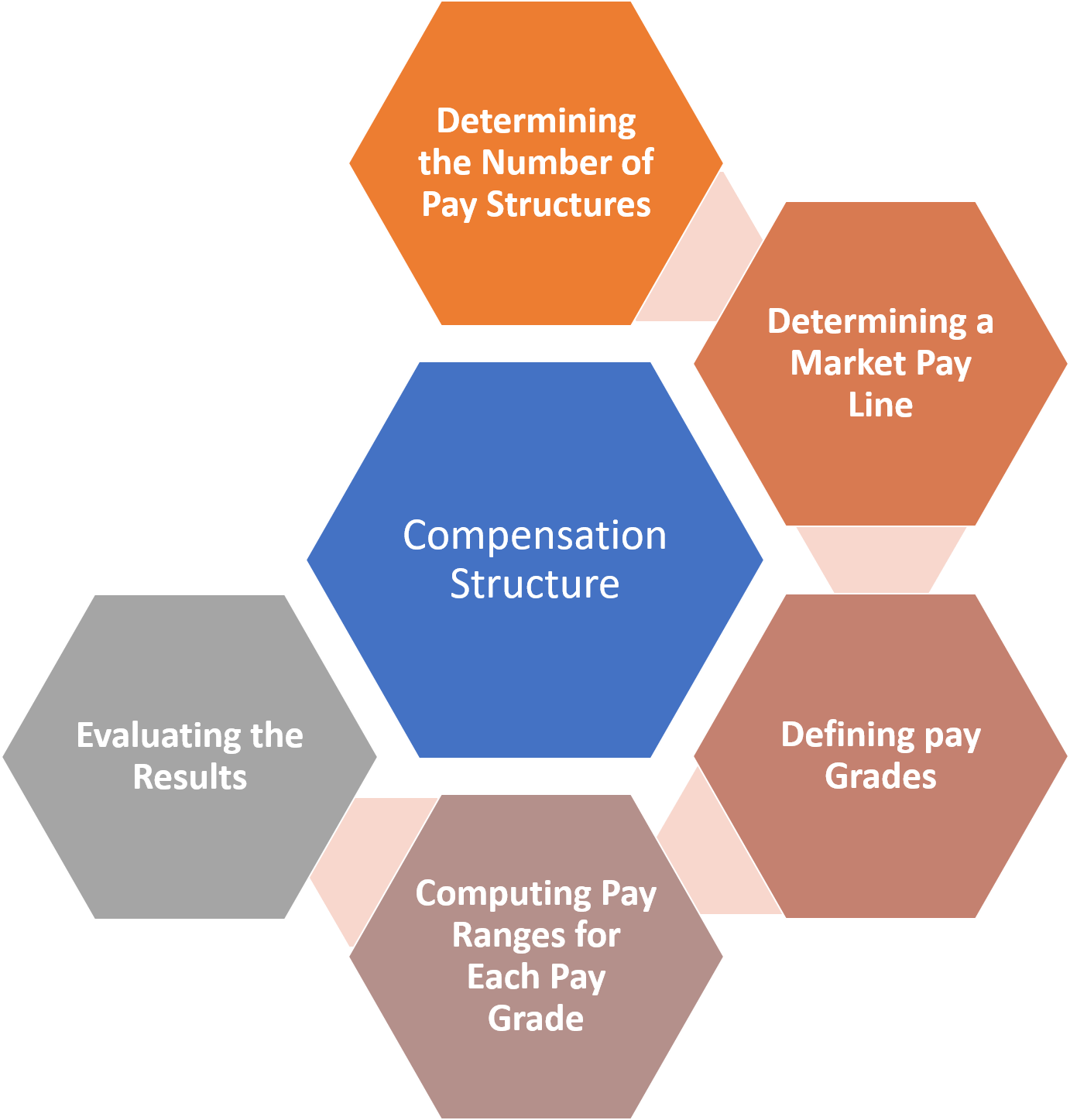

The combination of different compensation rates within any firm, which includes the amount of difference in the compensation between every level of the organisational structure, number of levels in the structure and the rate by which the employee in each structural level can progress is regarded as compensation structure. There are mainly five steps which are used by the compensation specialists to define and develop the compensation structure:

Determining the Number of Pay Structures

Depending upon the market rates and the job structure of the firm, more than one pay structure is decided by many firms. Most common pay structures include the following:

Exempt and Non-Exempt pay Structures: There will not be any kind of overtime pay provisions of the act in case of exempt compensation jobs. The core compensation for these jobs is normally in the form of annual salary. The overtime is provided according to the pay provision Of the act in case Of non-exempt compensation jobs. Hence, hourly pay rates are the basic mode Of compensation in ease of such jobs, In order to facilitate administrative ease, these kinds of pay structures are created by the firms.

Pay Structures Based on Job Family: Different job families are presented by executives, professional, clerical, craft, managerial and technical experts. Different job families are also used to define the pay structures which are used to represent a unique pattern of salary in the market.

Pay Structures Based on Geography: The pay structures are determined on the basis of prevailing rates in different geographical locations by the firms which have units or offices located in different geographical locations. These offices can be centres, manufacturing plants. corporate offices, sales offices, and so on. For example, the costs Of living in metropolitan cities are higher than urban or semi-urban locations.

Determining a Market Pay Line

Typical market pay rates in comparison to the job structure of the company are represented by the market pay line. Market competitive pay rates are those which conform to the pay levels prevailing in the industry currently. The pay rates which conform With the market pay rates are called competitive pay rates depending upon the selection criteria of the labour market. An internal consistency can be maintained with the help of these pay rates as there will be increment in these levels according to the value of jobs.

Defining pay Grades

In order to implement the pay policy, different jobs are combined by the pay grades. Different jobs are grouped by HR professionals as per the pay grades depending upon the same compensable elements and values. However, these methods are not so accurate. There exists no method for determining the accurate similarities in terms of contents and values so that different jobs can be grouped into different categories. Many other factors such as management’s philosophy, comprehensive pay grades and limited pay grades have the capabilities of affecting the job classification.

Computing Pay Ranges for Each Pay Grade

Pay grades are the basis of pay ranges. The horizontal aspect of the pay structure (job evaluation points) is represented by pay grades. On the other hand, the vertical dimension (pay rates) is represented by pay ranges. Mid, minimum and maximum pay rates are included in pay ranges. The acceptable ower and upper levels of pay for certain job within a certain pay grade are presented by the minimum and maximum levels. First of all, the midpoint is determined by HR professionals and then minimum and maximum points are decided. The central mark between the minimum and maximum rates is represented by the midpoint pay value. In most Of the cases, the market pay line which shows the competitive market rate governed by the analysis of compensation survey data is represented by the midpoints. Thus, the market median or average is represented by midpoint. By having a detailed knowledge of pay grade midpoint and the selected range spread, one can compute the minimum and maximum rates.

Green Circle Pay Rates: In some circumstances, the pay range which is given to the employees is below the minimum pay rates and this can happen When the employees do not match the minimum requirements for a certain job which are mentioned in the job specification part of job description. This below minimum pay scale is referred to as Green Circle Pay Rates. All the employees who are working on the green circle pay rates need to be brought to the normal pay rates as soon as possible and thus some significant steps are needed to be taken by both employers and employees so that the different types of deficiencies in skill or experience can be removed which are blameworthy for offering below the minimum pay range.

Red Circle Pay Rates: In some special cases some employees must be awarded more than the maximum pay ranges which is known as red circle rates. This kind of pay rates helps significantly in retaining the vital manpower in the organisations, which can otherwise have the attractive salary offers from the competitors. For their exceptional performances, red circle pay rates may be provided to the exemplary employees especially in the events when the promotion to a higher pay grade is not provided to them. The red circle pay rates are also given to those employees who receive demotion to the lower maximum rates than the employee’s present pay range.

Evaluating the Results

Once the pay structures are decided by the compensation professionals as per the previous steps, the results must be analysed by them. Particularly the firm’s internal job values and the market value of same job must be compared to find out the difference. In case of some discrepancies, the firm should re-analyse the internal values of the jobs decided by them. If the pay ranges provided by the firm is greater than the market pay range, then the firm should determine whether providing the pay scales higher than the market values will hamper the achievement of their competitive advantage or not. On the other hand, if the pay scales are lower than the market value, then the firm needs to analyse that whether there is any negative impact on attracting and recruiting new talent and retaining the existing employees. The pay level of every employee must be analysed in comparison to the midpoint of the pay grade by the compensation professionals. The firm’s competitive position in comparison to the market is presented by the midpoint. To determine the relative competitiveness of internal pay Kites depending upon the midpoint of pay range, ‘Compa-ratios’ can be used. The following formula is used to determine this:

\[\text{Compa-ratios = }\frac{\text{Employee }\!\!’\!\!\text{ s pay rate}}{\text{Pay range midpoint}}\]

When the employee’s pay rate is same as the pay range midpoint, the value of compa-ratio Will be equal to l. The firms which try to match with the market policies will always try to have the compa-ratio as l. When the pay rate of the employees falls below the competitive pay rates for the job, the value will be less than 1 for compa-ratio. This kind of policy is adopted by the firms having market lag strategy. When the employee’s pay rate is greater than the competitive pay rates for the job, the values of compa-ratio will be greater than 1. The firms which try to have market led policies adopt compa-ratio more than l.